How Lamina Reviews can Save You Time, Stress, and Money.

Table of ContentsLamina Reviews Things To Know Before You BuyLamina Reviews Fundamentals ExplainedGet This Report on Lamina ReviewsHow Lamina Reviews can Save You Time, Stress, and Money.The Best Strategy To Use For Lamina ReviewsThe Best Guide To Lamina Reviews

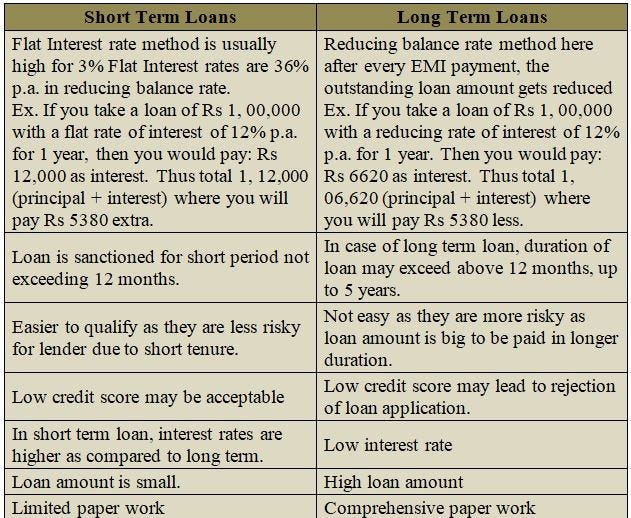

Numerous unprotected individual lendings have much longer repayment terms and reduced interest prices, which can offer customers accessibility to a large loan with reasonable monthly payments. Reasons That Individuals Obtain Short-Term Loans Many temporary car loans are a last hope for borrowers who may not get approved for various other sorts of car loans, as well as there are times when getting a pricey financing is far better than absolutely nothing.The Advantages and disadvantages of Short-Term Loans Short-term finances can be valuable when you're in a monetary pinch, but wage care. Here are some of the significant pros and cons. Pros: Several short-term fundings don't call for goodor anycredit to obtain your funding application approved.: The absence of a debt check can boost the authorization and financing process, which indicates you might have the ability to obtain the funding within the very same business day that you use.

Some Known Details About Lamina Reviews

What's the ordinary timespan for a temporary lending? Car loan settlement terms vary depending on the sort of temporary finance and also your state's policies. Many loans have to be settled within 14, 30, or 60 days, though some lenders use terms of six months to a year. 2. How high are rates of interest for temporary lendings? Comparing lendings' APRs can be a lot more handy than rates of interest, as the APR represent the settlement period, rate of interest, and lending institution's fees.

Exactly How Your Short-term Finance Repayments Are Determined Short-term car loans can help maintain your business out of warm water with accessibility to functioning funding when you require it. Our brief term loan calculator make up the main variables that influence paymentsloan amount, passion rate, finance term, as well as collateralto offer you a sense of the monthly payments your business will certainly owe.

Lamina Reviews Fundamentals Explained

You can fund as little as $2,500 or as high as $250,000. Brief Term Finance Rate Of Interest Rates Of Interest for short-term fundings typical 813% and are official source commonly repaired. Fixed rates are outstanding because they remain regular throughout the life of the funding, so you always understand specifically just how much your repayment will be.

Short Term Lending Er, Terms Short-term loans have, you recognize, much shorter terms in comparison to other lendings. A lot of them are 15 years and are backed by security such as a car, building, or one more substantial asset. Setting up extra collateral often helps you get a better offer on your car loan.

If you're contrasting lenders or markets, inquire about application charges before you apply. Source Costs Origination fees are charged by some lending institutions when a financing is funded. Ask if your loan provider has one and also just how much you can anticipate it to be to aid you determine the overall expense of your short-term funding.

The Facts About Lamina Reviews Revealed

You'll avoid late charges and also enhance your credit report. If you think you are going to miss a repayment, speak to your loan provider about it ahead of time. Set company website up automatic repayments. If you such as to make settlements manually, set schedule suggestions so you never fail to remember or miss out on a repayment. Find out where your loan provider stands on early repayment.

What's the difference in between individual fundings as well as payday car loans? While they might appear comparable, they are significantly various financial devices generally made use of by people with really various financial requirements. A is a "reasonably tiny amount of cash offered at address a high interest rate on the arrangement that it will certainly be settled when the debtor gets their next paycheck," as defined by the Consumer Financial Security Bureau.

These fees may be as long as 10-30 percent of your lending. That doesn't consist of any additional late fees if you are unable to pay off the financing promptly. Depending upon your loan provider, individual financings can feature their own collection of costs. An origination fee is a charge subtracted from your car loan amount upon becoming part of an agreement.

Some Of Lamina Reviews

Some loan providers might also include a prepayment penalty if you were to settle your finance prior to an agreed-upon time period. Fortunately is that some lending institutions don't consist of these financing charges, so you might avoid them if you do a little research on lending institutions. Discover Personal Loans, for instance, doesn't consist of any type of source fees or prepayment fees as part of their personal lending terms (Lamina Reviews).

Failing to repay the loan within that term might lead to extra charges and also rate of interest fees. Some loan providers allow borrowers to rollover a payday advance loan, which permits the customer to pay a charge to delay financing repayment. Individual fundings are long-lasting fundings that offer consumers a versatile settlement routine based upon their distinct economic circumstance.

With several lenders, consumers are cost-free to choose a timespan that fits their requirements. If the debtor is cash-flow aware, he/she can pick a longer timespan to reduce their regular monthly settlements. A shorter time framework can result in substantial cost savings on passion by paying the finance off quicker, yet may likewise sustain greater monthly payments.

What Does Lamina Reviews Do?

When using for an individual loan, be certain to read all of the great print. If the lending institution consists of high origination charges or closing expenses, it might be time to look elsewhere.